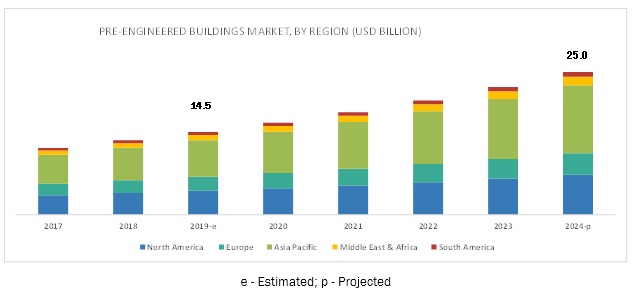

The global pre-engineered buildings market size is projected to grow from USD 14.5 billion in 2019 to USD 25.0 billion by 2024, at a CAGR of 11.5% during the forecast period. The increasing demand for green buildings and need for reduction in construction time and cost, along with the demand for lightweight building structure, are projected to drive the growth of the pre-engineered buildings market.

Asia Pacific accounted for the largest share in 2018 and is also projected to record the highest growth rate during the forecast period. The key factors driving the growth of the Asia Pacific pre-engineered buildings market are the growth in the residential and non-residential construction industry, huge investments in the infrastructural sector, and rapid industrialization in the developing countries of Asia Pacific. Furthermore, various benefits of these buildings, including time & cost efficiency and reduced environmental impact, as compared to cast-in-situ construction, are fueling the demand for these buildings in the developing countries of Asia Pacific.

To know about the assumptions considered for the study download the pdf brochure

Recent Developments

- In March 2019, Nucor Corporation has planned to expand its steel plate production capacity by building a steel plate mill in Brandenburg, KY, US. The company has planned an investment of USD 1.35 billion in the mill. This mill has a planned production capacity of 1.2 million tons of steel products per annum. This is expected to strengthen the company’s steel plate product portfolio, which is further expected to support its pre-engineered buildings production, as steel plates are used as a raw material to manufacture pre-engineered buildings.

- In August 2017, Zamil Steel Pre-engineered Building Company signed a contract with Agility Kuwait to build four air-conditioned warehouses in Mina Abdullah, Kuwait. This contract was valued at USD 6.7 million. Under this contract, the company would provide 4,600 metric tons of pre-engineered steel buildings and over 100,000 square meters of sandwich panels.

- In February 2016, Everest Industries built a 4.5 lac sq. ft. exhibition center, India Exposition Mart, in Greater Noida, India. This project was completed in 180 days and was valued at USD 5.22 million. This product launch is expected to enhance the company’s product portfolio.

The pre-engineered buildings market is dominated by major players such as BlueScope Steel (Australia), NCI Building Systems (US), Nucor Corporation (US), Kirby Building Systems (Kuwait), Zamil Steel Holding Company (Saudi Arabia), ATCO (Canada), Lindab Group (Sweden), PEBS Pennar (India), PEB Steel Buildings (Vietnam), and Everest Industries (India). These players adopt various growth strategies such as contracts/orders/project developments, new product developments, divestitures and expansions, and acquisitions to increase their market share. Contracts/orders/project developments were the most dominating strategies adopted by major players from January 2016 to March 2019; this helped them to improve their product offerings and broaden their customer base.